Diploma in

Financial

Technology

N/0412/4/0037 (MQA/PA 18514) 10/30

Become a Job-Ready FinTech Professional

From digital banking and blockchain to analytics and digital entrepreneurship, this career-driven diploma equips you with the business, tech, and innovation skills to thrive in the fast-growing world of Financial Technology.

You’ll learn how finance, technology, and regulation converge, and build the critical skills needed to work in tomorrow’s digital finance ecosystem.

Awarded by:

UNIMY

Duration:

2 years 3 months

Pathway:

Diploma

Study mode:

Full-time

Intakes:

February, May, July, & September

Assessments:

Coursework & Exams

The UNIMY Advantage

Your Future in FinTech Starts Here.

Master Real FinTech Tools & Platforms

Gain hands-on experience with digital payments, blockchain concepts, analytics tools, and financial platforms widely used across banking and digital finance.

Learn from Industry-Trained FinTech Experts

Our lecturers bring industry insights and real business experience from the financial and digital sectors — turning every class into practical, applied learning.

Industry Partnerships That Ignite Careers

Through collaborations with tech and finance partners, you’ll gain exposure to digital banking innovations, FinTech products, and future-ready technologies.

Earn Microcredentials from Global Tech Giants

Complement your diploma with bonus certifications from platforms like Coursera, IBM, AWS, or Google to boost your employability and stand out in the FinTech job market.

Earn Microcredentials from the

WORLD’S BEST UNIVERSITIES

& TECH GIANTS

Learn in Cutting-Edge

Labs & Smart Classrooms

COURSE MODULES

- Principles of Business & Management

- Principles of Marketing

- Principles of Accounting

- Microeconomics

- Human Resource Management

- Macroeconomics

- Introduction to FinTech

- Principles of FinTech Management

- Fundamentals of FinTech Governance

- Business Mathematics

- Organisational Behaviour

- Digital Currencies & Blockchain Technology

- Operations Management

- Digital Entrepreneurship

- Business Analytics

- Business Communication

- Design Thinking

- Digital Banking & Finance

- Business Finance

- Portfolio Management

- Business Law

- Industrial Training

- Penghayatan Etika dan Peradaban (Local students)

- Bahasa Melayu Komunikasi 1 (International students)

- New Venture Creation

- Integrity & Anti-Corruption

- Community Service

- Bahasa Kebangsaan A (If required)

Our IT Education Partners

The Fastest & Smartest Way

to a Career in FinTech

-

Start Here

- SPM

- O-Level

- (or equivalent)

-

- Diploma in Financial Technology

-

- Bachelor of Business Administration (Management Information System)

- Bachelor of Business Management (Financial Technology) (Hons)

-

- MBA

- PhD in Business Management

- DBA

Career Opportunities

With global digitalisation reshaping financial services, FinTech professionals are more in-demand than ever. This diploma prepares you for impactful roles in banking, finance, technology, and digital business.

Digital Banking Officer

- Support and manage operations across online banking platforms.

FinTech Product Analyst

- Analyse, test, and optimise digital financial products and solutions.

Financial Operations Executive

- Ensure smooth daily operations of financial processes and digital transactions.

Blockchain Associate

- Assist in blockchain-based projects, digital assets, and distributed ledger systems.

Crypto Analyst

- Analyse trends, market data, and behaviour within the cryptocurrency ecosystem.

Data Analytics Assistant

- Apply analytics to business and financial decision-making.

FinTech Support Engineer

- Support digital platforms, APIs, and systems used in fintech services.

Compliance Officer (FinTech/Banking)

- Ensure adherence to financial regulations, cybersecurity requirements, and governance frameworks.

Risk Management Assistant

- Identify and assess risks in digital finance systems.

Cybersecurity Analyst

- Protect financial platforms from digital threats and vulnerabilities.

Business Analyst (FinTech)

- Bridge business needs with tech-driven financial solutions.

ABOUT THE COURSE

HOW DO I GET IN?

You qualify with ANY of the following:

- SPM with credit in 3 subjects; OR

- SKM Level 3 (related field); OR

- MQF Level 3 Certificate (CGPA ≥ 2.00); OR

- STPM with Grade C (GP 2.0); OR

- STAM with minimum Maqbul; OR

- Equivalent qualifications recognised by the Malaysian Government.

Forecast / Trial results are accepted.

English Requirements

- MUET: Band 3.5

- IGCSE: Pass

- PTE: 47

- TOEFL iBT: 40

- Linguaskill: 154

- Or equivalent to CEFR High B1

MUET valid for 5 years. Other tests valid for 2 years.

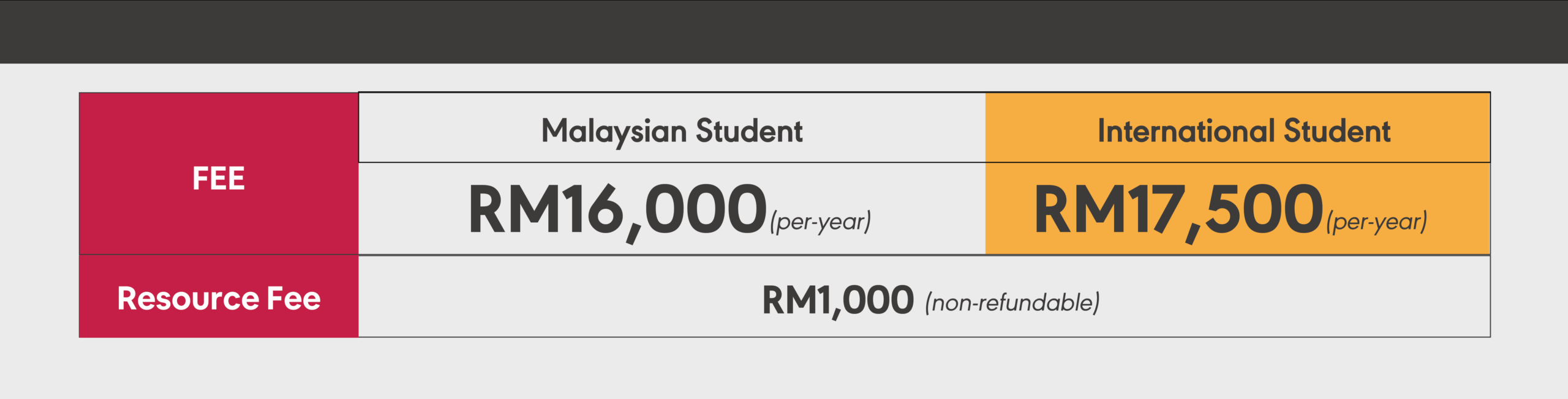

Programme Fees

FAQs

about the Diploma in Financial Technology

Yes. Students apply their learning in real workplace settings through Industrial Training, gaining hands-on exposure to fintech tools, data systems, and digital business operations.

It typically includes deeper research or project-based components, allowing students to specialise and demonstrate advanced expertise.

Yes. Students benefit from internships and collaborations with fintech and business organisations to gain real-world experience and professional networks.